Your information is guarded when it’s despatched towards the IRS. IRS Cost-free File lover businesses may not disclose or use tax return info for uses apart from tax return preparation with out your knowledgeable and voluntary consent.

Corporate taxes immediately affect a company's profitability and cash circulation. Superior tax fees can decrease a company's revenue just after taxes, which can limit its capacity to extend and mature its company. In contrast, lessen corporate tax prices will help organizations remain aggressive and foster growth.

Amy Soricelli has over 40 many years working with work candidates and it has honed the art of The work lookup in all locations. She presents a person-on-one particular session interview preparation skills or constructs resumes for career seekers.

The IFRS is usually a set of procedures issued with the Worldwide Accounting Specifications Board. These guidelines promote regularity and transparency in economic statements. GAAP is a list of specifications that accountants will have to adhere to every time they full economic statements for publicly traded companies inside the U.S.

What ever you need enter your location previously mentioned and we’ll do all of the legwork to obtain you rates from tax resolution specialists near you - speedy and absolutely free.

An empirical study demonstrates that state-stage corruption and corporate tax avoidance in America are positively similar.

Deferring cash flow: Corporations can decreased their tax legal responsibility by deferring profits to a long term tax yr. This method performs well when a business expects to get inside of a reduced tax bracket Sooner or later. This approach operates nicely so as to defer having to pay corporate taxes Later on.

On July 28, 1882, the Institute of Accountants and Bookkeepers of the town of The big apple became the 1st accounting Company which supports the necessity of people while in the accounting industry and for instructional needs.[5] With all the accountancy and marketplace growing in the world, the need of searching for products and services from Skilled accountants who experienced greater expectations and ended up acknowledged had been regarded.

Speediest Refund Feasible: Obtain your tax refund with the IRS as fast as is possible by e-filing and choosing to acquire your refund by direct deposit. Tax refund time frames will fluctuate. The IRS issues in excess of nine out of 10 refunds in a lot less than 21 days.

This FAQ articles continues to be made obtainable for informational purposes only. Learners are suggested to conduct added exploration to make certain programs and various credentials pursued satisfy their personal, Experienced, and financial goals.

Transfer pricing within the U.S. is governed by segment 482 of the Internal Profits Code (IRC) and applies when two or more corporations are owned or managed by a similar passions. Area 482 relates to all transactions in between related functions and typically managed parties, in spite of taxpayer intent, In line with CPA regulatory advice.

A CPA is a professional who usually takes care of many of the specific and necessary math jobs that go along with functioning a business. They might help with bookkeeping, payroll administration, and making ready economic files like tax returns and income-and-decline statements.

To aid the Texas CPA in implementing moral judgment in interpreting The foundations and deciding public fascination. General public curiosity ought to be put forward of self-desire, even when it means a loss of occupation or consumer.

AICPA customers permitted a proposed bylaw Modification to make eligible for voting membership people who Earlier held a CPA[35] certificate/license or have satisfied all the requirements for CPA certification in accordance Together with the Uniform Accountancy Act (UAA).

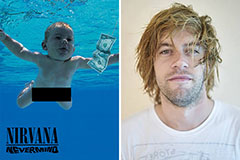

Spencer Elden Then & Now!

Spencer Elden Then & Now! Ross Bagley Then & Now!

Ross Bagley Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now! Nicholle Tom Then & Now!

Nicholle Tom Then & Now!